Deloitte Romania and Reff & Associates obtained a referral to the CJEU by the Bucharest Court of Appeal in a dispute regarding VAT on transactions not involving the supply of goods or services

11 Martie 2024 BizLawyer

The implications of the CJEU’s response will be profound in the current European context, as many multinational companies operate through a complex network of affiliated entities, and the acquisition of intra-group services is both a necessity and a widespread practice.

|

A multidisciplinary team of tax litigation lawyers from Reff & Associates | Deloitte Legal and tax advisors from Deloitte Romania has obtained a referral to the Court of Justice of the European Union (CJEU) by the Bucharest Court of Appeal in a dispute between a Romanian taxpayer and the national tax authority, concerning the VAT on transactions that regard transfer pricing adjustments. The opinion of the European court is important, as the applicable regulations in such cases are not clear enough and there aren’t any landmark decisions of European courts on similar disputes.

As a result, case C-726/23 was registered, which practically brings to CJEU's attention the VAT treatment applicable to invoices issued between companies within the same group, for the adjustment of prices in order to comply with the principles of market price in intra-group transactions and the allocation of profits according to the activities carried out and the risks assumed by each company. Specifically, these are invoices which do not regard the supply of goods or services, but for which VAT has been imposed by the tax authority. Thus, the European court should answer whether such transactions should be considered as having been carried out in respect of a transaction which is outside the scope of VAT or not.

As a result, case C-726/23 was registered, which practically brings to CJEU's attention the VAT treatment applicable to invoices issued between companies within the same group, for the adjustment of prices in order to comply with the principles of market price in intra-group transactions and the allocation of profits according to the activities carried out and the risks assumed by each company. Specifically, these are invoices which do not regard the supply of goods or services, but for which VAT has been imposed by the tax authority. Thus, the European court should answer whether such transactions should be considered as having been carried out in respect of a transaction which is outside the scope of VAT or not.

The implications of the CJEU’s response will be profound in the current European context, as many multinational companies operate through a complex network of affiliated entities, and the acquisition of intra-group services is both a necessity and a widespread practice.

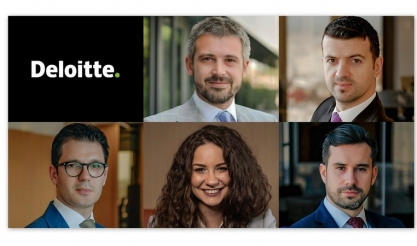

"The CJEU decision will have a significant impact on how these companies structure their intra-group operations and transactions internationally. We look forward to the court’s decision and we are proud that we can contribute to shaping the European tax framework by clarifying key issues related to the taxation of large taxpayers at European level. At the same time, we reaffirm our commitment to support our clients' interests against all tax challenges, which are becoming more and more complex," said Vlad Boeriu, Tax and Legal Partner-in-Charge, Deloitte Romania.

"Although this step represents only the first one in our efforts to obtain confirmation of the correctness of the tax treatment applied by our client, the future analysis that the CJEU will carry out is all the more welcome as the issue submitted to the attention of the European court has generated debate not only locally, but even in international tax forums", said Alex Slujitoru, Partner Reff & Associates | Deloitte Legal, leader of the tax litigation practice.

The team that contributed to this case also includes tax litigation lawyers Emanuel Bondalici, Senior Managing Associate, and Mircea Farcau, Managing Associate, Reff & Associates | Deloitte Legal, as well as Catalina Cojocaru, Senior Manager Indirect Tax, Deloitte Romania.

| Publicitate pe BizLawyer? |

|

| Articol 426 / 4652 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Consolidare strategică pe piața serviciilor medicale: Regina Maria achiziționează Neuroaxis, liderul clinicilor de neurologie din România | Ce consultanți au fost în tranzacție

Bondoc & Asociații, consultanții vânzătorilor în tranzacția prin care Grupul LuxVet preia rețeaua Mobile Vet

LegiTeam: CMS CAMERON MCKENNA NABARRO OLSWANG LLP SCP is looking for: Associate | Commercial group (3-4 years definitive ̸ qualified lawyer)

Neagu Dinu Partners, firmă înființată anul trecut, își face rapid loc în prim-planul practicii de Litigii & Arbitraj din piața locală, cu un model de lucru pragmatic, în care partenerii cooordonează dosarele și păstrează controlul calității în mandate complexe | De vorbă cu Simona Neagu (Partener fondator) despre așteptările tot mai ridicate ale clienților, colaborările internaționale și disciplina internă care susține performanța echipei

Clifford Chance Badea, consultant în emisiunea de obligațiuni prin care UniCredit Bank a atras 600 milioane de lei

Filip & Company și Legal Ground, arhitecții juridici ai tranzacției prin care BT Property, fondul imobiliar al Grupului Banca Transilvania, a cumpărat complexul de birouri Record Park din Cluj-Napoca de la un fond belgian. Echipele de avocați, coordonate de Ioana Roman și Alina Stancu Bîrsan, pentru cumpărător, și Alex Bumbu, pentru vânzător

O promovare din interior care confirmă meritocrația și creșterea organică într-una dintre cele mai puternice firme de avocatură din România | De vorbă cu Ramona Pentilescu, avocatul care a crescut în PNSA de la primii pași în profesie până la poziția de partener, despre vocație, rigoare și reperele care i-au susținut evoluția profesională într-un cadru în care contează respectul pentru profesie și coerența valorilor

Studenții la Drept sunt invitați la Turneul de dezbateri „Law and Life in Contest” organizat de Bondoc și Asociații

LegiTeam | RTPR is looking for a litigation lawyer (3-4 years of experience)

Filip & Company asistă Continental în vânzarea OESL către Regent. Alexandru Bîrsan (managing partner) a coordonat echipa

ICC Arbitration Breakfast revine în România cu cea de-a doua ediție - 18 martie, în București

În litigiile fiscale, Artenie, Secrieru & Partners este asociată cu rigoarea și eficiența, grație unei combinații rare de viziune, metodă și capacitate de execuție în dosare grele. De vorbă cu coordonatorii practicii despre noul ritm al inspecțiilor, reîncadrările tot mai frecvente și importanța unei apărări unitare, susținute de specialiști și expertize, într-un context fiscal tot mai imprevizibil

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS