NNDKP assists AAylex Group in securing a 20 million euro financing for the Group’s expansion in Romania and in the acquisition of Banvit Foods Romania

12 Mai 2021 BizLawyer

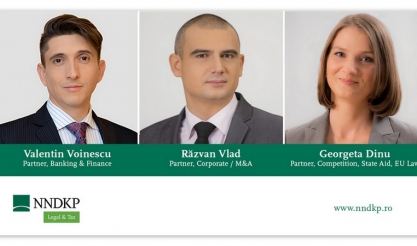

The NNDKP team assisting AAylex was coordinated by Valentin Voinescu, Partner (Banking and Finance Practice), Răzvan Vlad, Partner (Corporate/M&A) and Georgeta Dinu, Partner (Competition), and included Alexandru Ciambur and Cătălina Dan, Associates (Banking and Finance) and Vlad Anghel, Associate (Corporate/M&A).

|

Nestor Nestor Diculescu Kingston Petersen (NNDKP) successfully assisted AAylex Group, one of the leading Romanian players in the food industry, controlled by entrepreneur Bogdan Stanca as majority shareholder, in securing the funds necessary for the Group’s expansion in Romania through the acquisition of Banvit Foods Romania.

The AAylex Group, having former enterprise Avicola Buzau as its starting point, covers various operations ranging from genetics, feed production, breeding, incubation, broiler chicken farming to slaughtering and the distribution of processed chicken meat and value-added chicken meat products, under the Cocorico brand name. The acquisition of Banvit Foods, one of the leading producers of feed and “day old chicks” in Romania, will enable AAylex to optimize the operations of the Group, through a vertical integration of its activities “from farm to fork”.

The AAylex Group, having former enterprise Avicola Buzau as its starting point, covers various operations ranging from genetics, feed production, breeding, incubation, broiler chicken farming to slaughtering and the distribution of processed chicken meat and value-added chicken meat products, under the Cocorico brand name. The acquisition of Banvit Foods, one of the leading producers of feed and “day old chicks” in Romania, will enable AAylex to optimize the operations of the Group, through a vertical integration of its activities “from farm to fork”.

NNDKP assisted AAylex in connection with two separate components, which were handled concurrently. The first component entailed securing the financing, and the second one implementing the transaction for the acquisition of full ownership of Banvit Foods.

The financing of approximately EUR 20 million was granted in the form of a syndicated loan by CEC Bank and EximBank. In addition to funding the acquisition of an ownership interest in Banvit Foods, AAylex will use the loan to finance the day-to-day operations of the group of companies.

The assistance provided in connection with the acquisition of Banvit Foods entailed structuring the documents of the transaction, negotiating them with the shareholders of Banvit Foods, offering support in order to fulfill the conditions precedent agreed upon by the parties for the purposes of the transaction, and also taking all necessary actions in the closing stage of the transaction. Furthermore, NNDKP assisted AAylex before the Competition Council with a view to obtaining a favorable decision in relation to the concentration resulting from this acquisition.

The NNDKP team assisting AAylex was coordinated by Valentin Voinescu, Partner (Banking and Finance Practice), Răzvan Vlad, Partner (Corporate/M&A) and Georgeta Dinu, Partner (Competition), and included Alexandru Ciambur and Cătălina Dan, Associates (Banking and Finance) and Vlad Anghel, Associate (Corporate/M&A).

“This acquisition is of strategic importance for AAylex Group and represents the successful culmination of the extensive efforts made in the last 5 years. We are confident that the acquisition will generate added value in the following years, both from and internal and external perspective, while we will continue to offer premium quality experience to Cocorico clients”, stated Cristian Bărbulescu, Deputy CEO of AAylex Group.

“We are pleased to have been able to successfully assist the AAylex Group, a leading local player in the food industry, in connection with its expansion plans. The transaction reconfirms that the agri-food sector is a flagship component of the Romanian economy, having significant growth potential, and we are honored that our team could support the efforts of visionary and business-savvy Romanian entrepreneurs”, said Valentin Voinescu, Partner in the Banking and Finance practice.

“The transaction concluded between AAylex and Banvit Foods supports the efforts of further consolidating the production and supply chain of the conglomerate run by Bogdan Stanca, in a fiercely competitive industry. We are proud to be able to play a part in this complex process – with ramifications also in terms of innovation and technology – which follows a long-term strategy”, said Răzvan Vlad, Partner in the Corporate / M&A practice.

The NNDKP Banking and Finance team is constantly involved in complex projects concerning corporate finance, project finance, acquisitions of financial institutions and international and local companies, or public sector finance. Over the last three years alone, the members of the team were involved in financing transactions amounting to more than EUR 3.5 billion in sectors such as agribusiness, energy, real estate, infrastructure, FMCG, production or technology.

NNDKP’s Corporate / M&A practice has set benchmarks for over 30 years by advising on some of the most sophisticated high-profile transactions on the Romanian market. Currently a 22-lawyer team, one of the largest teams of M&A specialists on the local market, our lawyers were involved during the past 12 months alone in more than 35 noteworthy M&A deals, both domestic and cross-border.

NNDKP’s Competition team is a market leader in Romania. Our practice has a constant and robust portfolio of competition projects, including investigations, merger clearance projects, compliance projects, as well as court cases, where our representation often resulted in the reduction of the fines applied.

| Publicitate pe BizLawyer? |

|

| Articol 2431 / 4261 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Senior Lawyer Employment | Reff & Associates

Cine sunt și cum gândesc profesioniștii evidențiați de Legal 500 în GC Powerlist Romania | De vorbă cu Alexandru Berea, General counsel la BCR: ”Prin colaborare putem genera schimbări semnificative nu doar în interiorul profesiei noastre, ci și în societate in general. Prin natura muncii noastre, nu numai că răspundem la nevoile imediate ale societății, dar suntem și arhitecți ai viitorului acesteia, contribuind la definirea și modelarea unui cadru normativ care să orienteze comportamentul și deciziile individuale și colective pe termen lung”

Rebecca Marina, counsel în cadrul firmei Filip & Company după ultima rundă de promovări: “Am găsit aici oameni care îmi împărtășesc principiile și valorile de viață și care mi-au devenit prieteni și mentori sau pentru care eu am devenit mentor mai târziu. Orice promovare vine cu responsabilități și noi roluri în echipă”

Patru case locale de avocați rămân în topul global al celor mai bune 100 de firme implicate în arbitraje internaționale | Cum sunt prezentate în GAR 100 (2024), ce mandate au avut și ce spun clienții despre avocați și prestațiile acestora. TZA, ZRVP, LDDP și SP asistă clienți în arbitraje cu pretenții de 15,7 miliarde de dolari

Kinstellar a asistat BIG Mega Renewable Energy cu privire la finanțarea de 92 mil. € cu BERD și OTP Bank pentru construcția și operarea Parcului Eolian Urleasca

Răzvan Gheorghiu-Testa, fondator al Țuca Zbârcea & Asociații, inclus în „Top 50 Cei Mai Influenți Oameni de pe Piața Imobiliară din România”

Wolf Theiss a asistat AIRSOL în legătură cu achiziția MedAir Oxygen Solution | Emanuele Lainati, Legal Affair Manager SOL Group: “Expertiza, dedicarea și abordarea proactivă a avocaţilor Wolf Theiss au fost esențiale pentru încheierea cu succes a tranzacției”

Filip & Company a asistat Centrokinetic, în parteneriat cu Agista, în achiziția pachetului majoritar de părți sociale ale clinicii Socrates din Timișoara

Arbitrajul ICSID cerut de Nova Group Investments a ajuns la final | Statul român așteaptă decizia, după ce tribunalul a declarat închisă procedura în litigiul în care pretențiile se ridică la 345 mil. E. Ce onorarii au fost plătite firmelor de avocați care au asigurat apărarea

LegiTeam: Reff & Associates is looking for a 3-5 years Atorney at Law | Dispute Resolution

LegiTeam: Reff & Associates is looking for a 0-3 years Atorney at Law | Dispute Resolution

După un an plin, în care s-au implicat în peste 20 de tranzacții, avocații de M&A de la PNSA au acum în lucru peste zece mandate „cu greutate” | Silviu Stoica, partener: ”Există un interes crescut al fondurilor de private equity, dar și al investitorilor strategici și instituționali. Avem proiecte în cele mai variate domenii”

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS