Deloitte Romania and Reff & Associates obtained a referral to the CJEU by the Bucharest Court of Appeal in a dispute regarding VAT on transactions not involving the supply of goods or services

11 Martie 2024 BizLawyer

The implications of the CJEU’s response will be profound in the current European context, as many multinational companies operate through a complex network of affiliated entities, and the acquisition of intra-group services is both a necessity and a widespread practice.

|

A multidisciplinary team of tax litigation lawyers from Reff & Associates | Deloitte Legal and tax advisors from Deloitte Romania has obtained a referral to the Court of Justice of the European Union (CJEU) by the Bucharest Court of Appeal in a dispute between a Romanian taxpayer and the national tax authority, concerning the VAT on transactions that regard transfer pricing adjustments. The opinion of the European court is important, as the applicable regulations in such cases are not clear enough and there aren’t any landmark decisions of European courts on similar disputes.

As a result, case C-726/23 was registered, which practically brings to CJEU's attention the VAT treatment applicable to invoices issued between companies within the same group, for the adjustment of prices in order to comply with the principles of market price in intra-group transactions and the allocation of profits according to the activities carried out and the risks assumed by each company. Specifically, these are invoices which do not regard the supply of goods or services, but for which VAT has been imposed by the tax authority. Thus, the European court should answer whether such transactions should be considered as having been carried out in respect of a transaction which is outside the scope of VAT or not.

As a result, case C-726/23 was registered, which practically brings to CJEU's attention the VAT treatment applicable to invoices issued between companies within the same group, for the adjustment of prices in order to comply with the principles of market price in intra-group transactions and the allocation of profits according to the activities carried out and the risks assumed by each company. Specifically, these are invoices which do not regard the supply of goods or services, but for which VAT has been imposed by the tax authority. Thus, the European court should answer whether such transactions should be considered as having been carried out in respect of a transaction which is outside the scope of VAT or not.

The implications of the CJEU’s response will be profound in the current European context, as many multinational companies operate through a complex network of affiliated entities, and the acquisition of intra-group services is both a necessity and a widespread practice.

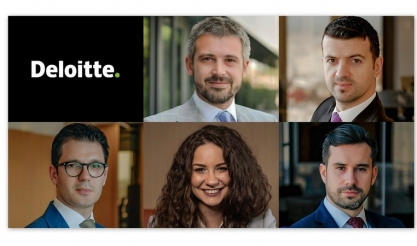

"The CJEU decision will have a significant impact on how these companies structure their intra-group operations and transactions internationally. We look forward to the court’s decision and we are proud that we can contribute to shaping the European tax framework by clarifying key issues related to the taxation of large taxpayers at European level. At the same time, we reaffirm our commitment to support our clients' interests against all tax challenges, which are becoming more and more complex," said Vlad Boeriu, Tax and Legal Partner-in-Charge, Deloitte Romania.

"Although this step represents only the first one in our efforts to obtain confirmation of the correctness of the tax treatment applied by our client, the future analysis that the CJEU will carry out is all the more welcome as the issue submitted to the attention of the European court has generated debate not only locally, but even in international tax forums", said Alex Slujitoru, Partner Reff & Associates | Deloitte Legal, leader of the tax litigation practice.

The team that contributed to this case also includes tax litigation lawyers Emanuel Bondalici, Senior Managing Associate, and Mircea Farcau, Managing Associate, Reff & Associates | Deloitte Legal, as well as Catalina Cojocaru, Senior Manager Indirect Tax, Deloitte Romania.

| Publicitate pe BizLawyer? |

|

| Articol 422 / 4648 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Clifford Chance a asistat BEI, BERD și BCR în acordul de finanțare semnat cu Scatec pentru dezvoltarea și exploatarea unei centrale solare cu o capacitate de 189,7 MWp. Echipă transfrontalieră cu 6 avocați din București în prim plan

Chambers Global 2026 | RTPR rămâne singura firmă de avocați listată pe prima poziție în ambele arii de practică analizate: Corporate ̸ M&A și Banking & Finance. Filip & Company este în prima bandă în Corporate ̸ M&A. Firmele care au cei mai mulți avocați evidențiați sunt RTPR (9), Filip & Company (8), CMS (6) și Clifford Chance Badea (5)

Clifford Chance Badea a asistat Electro-Alfa International în IPO-ul de 580 milioane RON, una dintre cele mai de succes listări realizate de o companie antreprenorială din România. Echipa a fost condusă de Radu Ropotă (Partener)

Eversheds Sutherland își întărește linia de arbitraj la București prin cooptarea Luminiței Popa ca partener | Un nume de referință în arbitrajul internațional revine într-o echipă integrată, după perioada dedicată practicii independente

ICC Arbitration Breakfast revine în România cu cea de-a doua ediție - 18 martie, în București

În litigiile fiscale, Artenie, Secrieru & Partners este asociată cu rigoarea și eficiența, grație unei combinații rare de viziune, metodă și capacitate de execuție în dosare grele. De vorbă cu coordonatorii practicii despre noul ritm al inspecțiilor, reîncadrările tot mai frecvente și importanța unei apărări unitare, susținute de specialiști și expertize, într-un context fiscal tot mai imprevizibil

NNDKP obține o decizie semnificativă pentru litigiile privind prețurile de transfer din partea de vest a României. Echipă mixtă, cu avocați din Timișoara și București, în proiect

ZRVP și anatomia unei investigații interne conduse impecabil | O discuție cu Doru Cosmin Ursu (Managing Associate) despre metodă, rigoare probatorie și coordonare strânsă între specializări, în mandate sensibile, inclusiv transfrontaliere, care oferă managementului claritate și opțiuni concrete de acțiune

Cum se formează un Partener într-o firmă de avocatură de top | De vorbă cu Bianca Chiurtu, avocatul care a parcurs drumul de la stagiar la partener în cadrul PNSA, despre maturizarea profesională într-una dintre cele mai puternice case locale de avocați, despre echipă, mentorat și performanță într-o profesie în care presiunea este constantă, iar diferența o fac valorile clare și consistența profesională

Filip & Company a asistat Fortress Real Estate Investments Limited în cea de-a doua investiție din România în domeniul logistic. Ioana Roman (partener), coordonatoarea echipei în această tranzacție: „Piața logistică din România continuă să fie foarte atractivă pentru investitorii instituționali, datorită infrastructurii în continuă îmbunătățire, consumului în creștere și poziționării strategice în cadrul lanțurilor de aprovizionare regionale”

NNDKP a asistat Holcim România în legătură cu achiziția Uranus Pluton SRL. Ruxandra Bologa (Partener) a coordonat echipa

Practica de Real Estate a D&B David și Baias, între experiză profundă și inovare: echipă interdisciplinară, suport PwC și activitate intensă în retail, industrial și agri care permit structurarea tranzacțiilor cu risc redus, asigurarea lichidităților și implementarea rapidă a proiectelor | De vorbă cu Georgiana Bălan (Counsel) despre ”mișcările” din piața imobiliară și modul în care echipa oferă clienților predictibilitate, protecție și viteză în realizarea proiectelor

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS