NNDKP CELF confirms its position as leader in tax litigation: has obtained the referral to and will represent its client before the Court of Justice of the European Union in a tax dispute concerning VAT fixed establishments

29 Iunie 2021 BizLawyer

During the past years, the subject of VAT fixed establishments has become a favorite target of ANAF, initially starting with electricity/gas trading, later going to the distribution of pharmaceuticals, recently reaching toll manufacturing.

|

NNDKP CELF has successfully represented its client, a non-resident company, before the national court in which it has made a request for a preliminary ruling to the Court of Justice of the European Union (CJEU) concerning the interpretation of the EU VAT Directive and Regulation as regards the existence of a VAT fixed establishment.The dispute with the Romanian National Agency for Tax Administration (in Romanian: Agenția Națională de Administrare Fiscală or, in short, ANAF) occurred in connection with the provision of toll manufacturing services (or “lohn” contracts as they are commonly known in Romania).

In this case, the non-resident company acquired a complex manufacturing service from a related party, established in Romania. The non-resident company was the owner of the raw material and of the finished products while the resident company contributed with the labor and owned the related production equipment. In addition to the processing of raw material and transformation into finished products, the complex service included related activities such as reception, inventory, placing orders with suppliers of raw material, providing storage space, inventory management in the IT system, processing orders from customers of the finished products, mentioning the address on the transport documents and invoices, support in quality audits, etc. The finished products resulting from the processing were sold by the non-resident company mainly outside Romania under VAT exemption and, to a small extent, in Romania subject to VAT.

In this case, the non-resident company acquired a complex manufacturing service from a related party, established in Romania. The non-resident company was the owner of the raw material and of the finished products while the resident company contributed with the labor and owned the related production equipment. In addition to the processing of raw material and transformation into finished products, the complex service included related activities such as reception, inventory, placing orders with suppliers of raw material, providing storage space, inventory management in the IT system, processing orders from customers of the finished products, mentioning the address on the transport documents and invoices, support in quality audits, etc. The finished products resulting from the processing were sold by the non-resident company mainly outside Romania under VAT exemption and, to a small extent, in Romania subject to VAT.

ANAF considered that the technical and human resources of the resident company are de facto at the disposal of the non-resident company. Thus, the non-resident company has a fixed establishment in Romania and therefore, the services provided by the resident company have the place of taxation in Romania, being subject to Romanian VAT.

During the past years, the subject of VAT fixed establishments has become a favorite target of ANAF, initially starting with electricity/gas trading, later going to the distribution of pharmaceuticals, recently reaching toll manufacturing.

ANAF's interest is justified by the widespread of these business models in Romania and the large amounts at stake, following the global trend of tax administrations to investigate not declared permanent / fixed establishments. We note that the Romanian tax authority has refined its analysis from one case to another, the arguments increasing in complexity and showing a detailed understanding of the business models.

The preliminary questions proposed by NNDKP CELF aim to clarify the fixed establishment from an EU law perspective, to correctly allocate the taxation rights between Romania and the EU Member State of residence of the beneficiary of the manufacturing services.

These questions refer to:

→ the possibility for a non-resident company to create a fixed establishment in Romania if it performs only supplies of goods (and not also services),

→ the scope of administrative-support services,

→ the place of consumption of manufacturing services given that the finished products were sold outside Romania and those sold in Romania were subject to VAT and

→ if there is a supply from a VAT perspective where the human and technical resources of the beneficiary involved in the services are the same with the resources of the provider.

NNDKP CELF has proposed a set of questions to allow the CJEU to settle this legal debate of interest to all companies involved in cross-border toll manufacturing services. The success of NNDKP CELF is even greater in the context in which the provisions of art. 267 paragraph 3 of the Treaty on the Functioning of the EU provide for the obligation to refer questions to the CJEU only before the court whose judgments can no longer be appealed under national law. In this dispute, the national court sending the request for the preliminary ruling to the CJEU is the first instance. However, the national court correctly accepted NNDKP CELF's arguments that the correct interpretation and application of EU law cannot be ensured in lack of a referral to the CJEU.

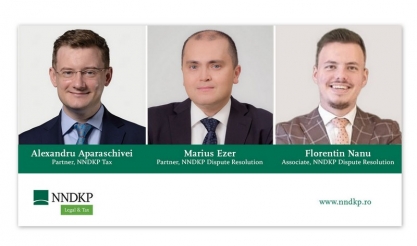

The NNDKP CELF core team providing assistance and representation in relation to this case includes Alexandru Aparaschivei, Tax Partner – VAT, NNDKP Tax Advisory, Marius Ezer, Partner, Dispute Resolution and Florentin Nanu, Associate, Dispute Resolution.

NNDKP established in 2019 the NNDKP Center of Excellence in Fiscal Disputes (NNDKP CELF), a specialized resource in the field of tax disputes. Through this center, the firm offers highly specialized advice to local and international companies and Romanian entrepreneurs, drawing on the extensive experience gained by the firm in over 325 fiscal disputes handled by an integrated team, comprised of 15 lawyers and tax advisors, experience that underpins the firm’s best practices in the field.

| Publicitate pe BizLawyer? |

|

| Articol 2473 / 4610 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Victorie Mușat & Asociații pentru o companie membră a Grupului TIU: fapte de concurență neloială săvârșite ocult, sancționate de instanță | Hotărârea setează un reper jurisprudențial în materia concurenței neloiale

Bondoc & Asociații a asistat ENGIE în achiziția unuia dintre cele mai mari proiecte eoliene din România. De cealaltă parte, Schoenherr a stat alături de Greenvolt Power pe tot parcursul tranzacției, care a implicat o structură contractuală complexă și multiple considerente de reglementare. Echipele, coordonate de Monica Iancu și Monica Cojocaru

Cea mai mare fuziune din istoria avocaturii de business: Hogan Lovells și Cadwalader, Wickersham & Taft au anunțat intenția de a se combina într-o singură firmă

Apreciată constant de ghidurile juridice internaționale pentru mandatele sofisticate, practica de Capital Markets a CMS România a devenit, prin consistență și profunzime, unul dintre pilonii reputației firmei pe piața locală și un reper important în rețeaua sa regională | De vorbă cu Cristina Reichmann (Partener) despre disciplina pregătirii pentru bursă, finețea aplicării regulilor de piață și forța unei echipe care lucrează articulat, cu roluri clare și obiective aliniate

PNSA a asistat Grupul Société Générale în finalizarea vânzării BRD Pensii. Echipa, coordonată de Silviu Stoica (Avocat Asociat) și Florian Nițu (Avocat Asociat Coordonator)

NNDKP, parte din echipa juridică internațională care a asistat Metinvest în achiziția ArcelorMittal Iași

Mușat & Asociații obține o nouă victorie definitivă pentru NUROL într-un proiect strategic de infrastructură rutieră

Record de promovări la Țuca Zbârcea & Asociații: trei noi parteneri și alte 16 numiri interne | Florentin Țuca, Managing Partner: ”Această serie de promovări, una dintre cele mai extinse din istoria noastră, coincide cu aniversarea a 20 de ani de la fondarea firmei, un moment ce reconfirmă valoarea, profesionalismul și dăruirea întregii noastre echipe”

Filip & Company a organizat în parteneriat cu Asociația Studenților în Drept cea de-a zecea ediție a Concursului de negocieri simulate „Teodora Tudose”

MAXIM ̸ Asociații asistă EMSIL TECHTRANS în tranzacția imobiliară încheiată cu METSO pentru o proprietate industrială din Oradea

Mitel & Asociații dezvoltă o practică de litigii construită în jurul unui nucleu de avocați cu mare experiență, capabilă să ducă la capăt mandate complexe cu impact financiar și reputațional major, într-o piață în care disputele devin tot mai tehnice și mai dure | De vorbă cu Magda Dima (Partener) despre cum se construiește strategia, se evaluează riscurile și se formează generația nouă de litigatori

Echipa de Concurență a RTPR îmbină experiența cu precizia operațională, într-o formulă remarcată în Legal 500 și Chambers | De vorbă cu partenerii Valentin Berea și Roxana Ionescu despre modul de lucru care privilegiază consistența și rigoarea, cu rezultate ce confirmă profesionalismul și anvergura practicii

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS