NNDKP assists AAylex Group in securing a 20 million euro financing for the Group’s expansion in Romania and in the acquisition of Banvit Foods Romania

12 Mai 2021 BizLawyer

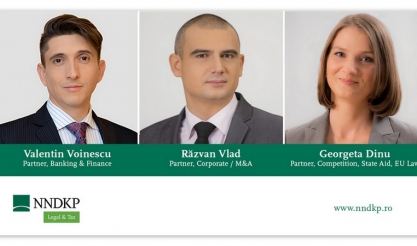

The NNDKP team assisting AAylex was coordinated by Valentin Voinescu, Partner (Banking and Finance Practice), Răzvan Vlad, Partner (Corporate/M&A) and Georgeta Dinu, Partner (Competition), and included Alexandru Ciambur and Cătălina Dan, Associates (Banking and Finance) and Vlad Anghel, Associate (Corporate/M&A).

|

Nestor Nestor Diculescu Kingston Petersen (NNDKP) successfully assisted AAylex Group, one of the leading Romanian players in the food industry, controlled by entrepreneur Bogdan Stanca as majority shareholder, in securing the funds necessary for the Group’s expansion in Romania through the acquisition of Banvit Foods Romania.

The AAylex Group, having former enterprise Avicola Buzau as its starting point, covers various operations ranging from genetics, feed production, breeding, incubation, broiler chicken farming to slaughtering and the distribution of processed chicken meat and value-added chicken meat products, under the Cocorico brand name. The acquisition of Banvit Foods, one of the leading producers of feed and “day old chicks” in Romania, will enable AAylex to optimize the operations of the Group, through a vertical integration of its activities “from farm to fork”.

The AAylex Group, having former enterprise Avicola Buzau as its starting point, covers various operations ranging from genetics, feed production, breeding, incubation, broiler chicken farming to slaughtering and the distribution of processed chicken meat and value-added chicken meat products, under the Cocorico brand name. The acquisition of Banvit Foods, one of the leading producers of feed and “day old chicks” in Romania, will enable AAylex to optimize the operations of the Group, through a vertical integration of its activities “from farm to fork”.

NNDKP assisted AAylex in connection with two separate components, which were handled concurrently. The first component entailed securing the financing, and the second one implementing the transaction for the acquisition of full ownership of Banvit Foods.

The financing of approximately EUR 20 million was granted in the form of a syndicated loan by CEC Bank and EximBank. In addition to funding the acquisition of an ownership interest in Banvit Foods, AAylex will use the loan to finance the day-to-day operations of the group of companies.

The assistance provided in connection with the acquisition of Banvit Foods entailed structuring the documents of the transaction, negotiating them with the shareholders of Banvit Foods, offering support in order to fulfill the conditions precedent agreed upon by the parties for the purposes of the transaction, and also taking all necessary actions in the closing stage of the transaction. Furthermore, NNDKP assisted AAylex before the Competition Council with a view to obtaining a favorable decision in relation to the concentration resulting from this acquisition.

The NNDKP team assisting AAylex was coordinated by Valentin Voinescu, Partner (Banking and Finance Practice), Răzvan Vlad, Partner (Corporate/M&A) and Georgeta Dinu, Partner (Competition), and included Alexandru Ciambur and Cătălina Dan, Associates (Banking and Finance) and Vlad Anghel, Associate (Corporate/M&A).

“This acquisition is of strategic importance for AAylex Group and represents the successful culmination of the extensive efforts made in the last 5 years. We are confident that the acquisition will generate added value in the following years, both from and internal and external perspective, while we will continue to offer premium quality experience to Cocorico clients”, stated Cristian Bărbulescu, Deputy CEO of AAylex Group.

“We are pleased to have been able to successfully assist the AAylex Group, a leading local player in the food industry, in connection with its expansion plans. The transaction reconfirms that the agri-food sector is a flagship component of the Romanian economy, having significant growth potential, and we are honored that our team could support the efforts of visionary and business-savvy Romanian entrepreneurs”, said Valentin Voinescu, Partner in the Banking and Finance practice.

“The transaction concluded between AAylex and Banvit Foods supports the efforts of further consolidating the production and supply chain of the conglomerate run by Bogdan Stanca, in a fiercely competitive industry. We are proud to be able to play a part in this complex process – with ramifications also in terms of innovation and technology – which follows a long-term strategy”, said Răzvan Vlad, Partner in the Corporate / M&A practice.

The NNDKP Banking and Finance team is constantly involved in complex projects concerning corporate finance, project finance, acquisitions of financial institutions and international and local companies, or public sector finance. Over the last three years alone, the members of the team were involved in financing transactions amounting to more than EUR 3.5 billion in sectors such as agribusiness, energy, real estate, infrastructure, FMCG, production or technology.

NNDKP’s Corporate / M&A practice has set benchmarks for over 30 years by advising on some of the most sophisticated high-profile transactions on the Romanian market. Currently a 22-lawyer team, one of the largest teams of M&A specialists on the local market, our lawyers were involved during the past 12 months alone in more than 35 noteworthy M&A deals, both domestic and cross-border.

NNDKP’s Competition team is a market leader in Romania. Our practice has a constant and robust portfolio of competition projects, including investigations, merger clearance projects, compliance projects, as well as court cases, where our representation often resulted in the reduction of the fines applied.

| Publicitate pe BizLawyer? |

|

| Articol 2813 / 4643 | Următorul articol |

| Publicitate pe BizLawyer? |

|

BREAKING NEWS

ESENTIAL

Cum se formează un Partener într-o firmă de avocatură de top | De vorbă cu Bianca Chiurtu, avocatul care a parcurs drumul de la stagiar la partener în cadrul PNSA, despre maturizarea profesională într-una dintre cele mai puternice case locale de avocați, despre echipă, mentorat și performanță într-o profesie în care presiunea este constantă, iar diferența o fac valorile clare și consistența profesională

NNDKP a asistat Holcim România în legătură cu achiziția Uranus Pluton SRL. Ruxandra Bologa (Partener) a coordonat echipa

Practica de litigii de la Băncilă, Diaconu & Asociații funcționează ca un vector de influență în piață, capabil să genereze nu doar soluții favorabile punctuale, ci și transformări de fond în modul în care sunt interpretate și aplicate normele legale în domenii cheie ale economiei | De vorbă cu Emanuel Băncilă (Senior Partner) și Adriana Dobre (Partener) despre dinamica pieței, sofisticarea conflictelor juridice și infrastructura invizibilă a performanței în litigii

În spatele scenei, alături de experimentata echipă de Investigații de la Mușat & Asocații, descrisă de ghidurile juridice internaționale drept un reper al pieței românești în white-collar crime | Detalii mai puțin cunoscute despre modul în care lucrează avocații, aproape invizibili pentru angajații clientului, cum se obține ”tabloul probator” respectând legislația și drepturile angajaților, metodele folosite și provocările des întâlnite în astfel de mandate, într-o discuție cu partenerii Ștefan Diaconescu și Alexandru Terța, doi dintre cei mai experimentați avocați de pe piața locală

Practica de Real Estate a D&B David și Baias, între experiză profundă și inovare: echipă interdisciplinară, suport PwC și activitate intensă în retail, industrial și agri care permit structurarea tranzacțiilor cu risc redus, asigurarea lichidităților și implementarea rapidă a proiectelor | De vorbă cu Georgiana Bălan (Counsel) despre ”mișcările” din piața imobiliară și modul în care echipa oferă clienților predictibilitate, protecție și viteză în realizarea proiectelor

Clifford Chance Badea, consultantul juridic al băncilor în tranzacția prin care BCR și Erste Group finanțează cu 58,5 mil. € parcul eolian din Săcele, dezvoltat de Greenvolt Power

Nestor Nestor Diculescu Kingston Petersen, câștigătoarea premiului Future Lawyers Programme of the Year acordat de Legal Benchmarking Group

Promovări la Schoenherr | Magdalena Roibu a devenit Partner, Adriana Stănculescu a preluat în rolul de Counsel, iar Carla Filip și Sabina Aionesei au făcut un pas înainte în carieră

Piața imobiliară recompensează proiectele bine fundamentate juridic și urbanistic și penalizează improvizația, spun avocații de Real Estate de la Mitel & Asociații. Din această perspectivă, ajustarea actuală nu este o resetare, ci un pas necesar către maturizarea pieței și consolidarea încrederii între dezvoltatori, finanțatori și beneficiari | De vorbă cu Ioana Negrea (Partener) despre disciplina due-diligence-ului, presiunea urbanismului în marile orașe și modul în care echipa gestionează mandatele

KPMG Legal – Toncescu și Asociații își consolidează practica de Concurență într-o zonă de maturitate strategică, în care mandatele sensibile sunt gestionate cu viziune, disciplină procedurală și o capacitate reală de anticipare a riscurilor | De vorbă cu Mona Banu (Counsel) despre modul în care se schimbă natura riscurilor și cum se repoziționează autoritățile, care sunt liniile mari ale noilor investigații și cum face diferența o echipă compactă, cu competențe complementare și reflexe formate pe cazuri complicate

Promovări în echipa RTPR: patru avocați urcă pe poziția de Counsel, alți șapte fac un pas înainte în carieră | Costin Tărăcilă, Managing Partner: ”Investim în profesioniști care reușesc să transforme provocările juridice în soluții strategice, consolidând poziția firmei noastre ca lider în România și oferind clienților noștri cele mai bune servicii”

Mușat & Asociații intră și în arbitrajul ICSID inițiat de Starcom Holding, acționarul principal al grupului Eurohold Bulgaria și va lupta, de partea statului român, cu Pinsent Masons (Londra), DGKV (Sofia) și CMS (București)

Citeste pe SeeNews Digital Network

-

BizBanker

-

BizLeader

- in curand...

-

SeeNews

in curand...

RSS

RSS